It costs a lot of money to fund a drug habit. Unfortunately, the destructive nature of drug addiction drastically alters our priorities, making it difficult to find or keep a job and otherwise sabotaging any potential means of income. Addicted persons quickly find themselves with maxed-out credit cards or high-interest loans. Cars may be repossessed due to months of overdue payments. Homelessness is common; as paying rent or mortgage falls by the wayside in order to acquire more drugs.

The descent into financial ruin is quick and sharp, and something that occurs all too often. Even after completing treatment, the financial consequences still linger, making it difficult to pursue your new, sober life. Learning how to face the financial wreckage of your addiction is an important aspect of addiction recovery, that’s just as impactful as regaining your physical health.

The Reality of Your Finances After Addiction

We won’t sugarcoat it, trying to get your finances together after addiction is tough. If you don’t have a job it can be difficult to get one, having to explain the large work history gap on your resume. Your credit, a crucial aspect of your financial health, has likely been destroyed from irresponsible credit card usage, unpaid loans, repossessions, evictions, or bankruptcy—all of which are difficult to bounce back from. You may also have mounting legal bills and court costs that you need to deal with if you run into legal trouble during your addiction.

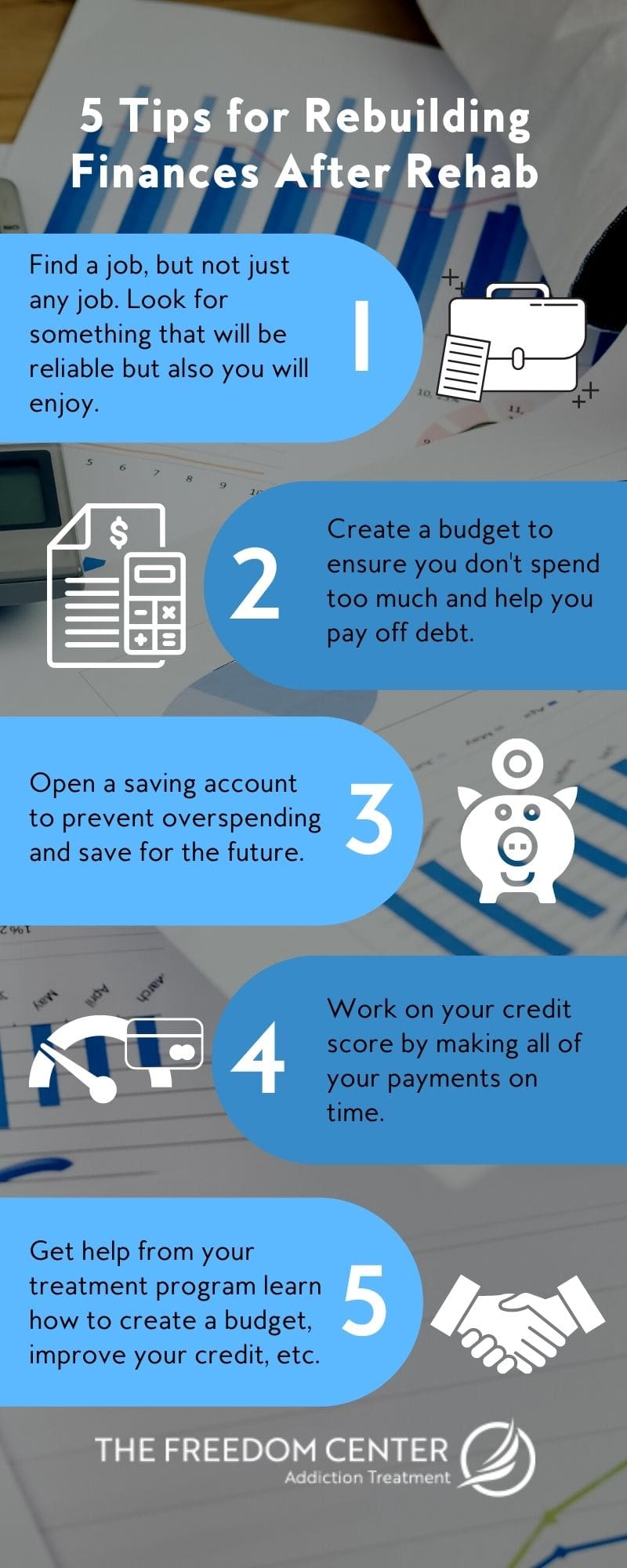

The key to rebuilding your finances—no matter the reason why they were damaged in the first place—is patience and consistency. This is easier said than done, but if you focus on the strategies mentioned above, your credit and financial situation should improve naturally. Here are 4 essential tips on rebuilding your finances after addiction:

Assess the damage

It’s going to be difficult to face all of the financial problems you have racked up, but don’t panic! Knowing the full extent of what you have to deal with is the first step in finding solutions. Write down everything you owe, and to who you owe it. Call your creditors. Explain that you have been struggling with a long-term illness but are working on getting your finances in order. You could even be totally honest and tell them you are in recovery from a substance abuse problem. By calling, you may be able to work out a payment plan or even have a portion of your debt forgiven altogether. However, you won’t know your options until you reach out.

Get a job

This can be a tough one, especially if you have a criminal record. However, there are many companies willing to hire good people with criminal pasts. Check out Jobs for Felons. Even without legal issues, you might find the process of finding a job difficult because you haven’t had one for an extended period of time. Local staffing agencies can be a great resource as they have opportunities for various skill and experience levels and can get you placed quickly. Some even offer resume-building workshops and assistance on getting back into the workforce. If you were once willing to do whatever it took to get high, you can do whatever it takes to get a job.

Live below your means

Track down all of your expenses. Every. Single. One. No matter how small. Learn how to distinguish between a want versus a need. The essentials are those tried to your immediate survival: housing, food, medication, transportation to get to/from work, etc. Everything else (entertainment, getting your hair cut, upgrading your cell phone) can wait.

The reason being that if your credit is severely compromised, you will have very little credit (if any at all) to your name. That means if you spend even a single cent over what you can afford, you can get slammed with a cascade of fees that put you even further in debt. A benefit, however, is that regular and on-time payments of your bills can actually repair your credit while teaching you crucial budget-management skills.

Pay your bills on time

Repairing your credit requires a two-pronged approach: pay your debts and do so on time. Consistent, on-time payments can show creditors that you are trustworthy. It will also lower your total debt-to-income ratio (DTI) which makes it much easier to buy a house or finance a car. Eventually, your credit score will improve, which will give you access to more lines of credit and at better rates (which will save you money in the long run).

Tackle your highest interest debt first and try to pay more than the minimum payment amount (you’ll pay a lot more in the long run). If you need credit to make ends meet, consider a secured credit card. These credit cards are specifically designed to help people with bad credit and can give you a bit more breathing room in between pay periods. Just be sure to pay back your monthly balance in full each month, otherwise, you’ll end up getting slammed with fees.

Stay focused on your recovery

This is the most important part. You can get through anything as long as you stay clean and sober. And don’t lose hope – there are millions of people that have found freedom from both addiction and financial catastrophes. Find more addiction recovery resources like these to help regain control over your life.

Testimonial from Amethyst Alumni: Kaelan Lanie

“Today I applied for a credit card. I sat across the desk from my banker and she asked me what I did for work. I explained that I provided help to people who are struggling with substance use disorder. She was a little taken back and then asked me how I had got into the field. I told her I was in recovery. I could tell she was surprised her by the way her face lit up.

A little over 16 months ago the only thing I cared about was how I could lie, con, and manipulate to get my next fix. My days and nights consisted of being locked in a room with the blinds closed and a pipe pressed tightly to my lips. Submerged in my own guilt and shame to even consider being a part of society.

But yet here we are, 16 months later; and I care about things like building my credit (how odd). It might not seem like that big of a deal to some people, and it wasn’t a big deal to me at first either. I felt like I was just doing what I was supposed to be doing. But the reaction I got from my banker made me realize how much of a miracle my life truly is.

I got approved for the card.”

-Kaelan Lanie